rhode island income tax rate 2020

Tax Rate 0. Find your income exemptions.

Pass Through Entity Election Ri Division Of Taxation

You will need to pay 6 of the first 7000 of taxable income for each employee per year which makes your maximum FUTA tax per employee per year 420Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06.

. Discover Helpful Information and Resources on Taxes From AARP. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. DATEucator - Your 2022 Tax Refund Date.

Tax rate of 375 on the first 68200 of taxable income. Phase-out range for standard deduction exemption amounts by tax year 2020 2021. Rhode Island Tax Brackets for Tax Year 2020.

Tax rate of 599 on taxable income over 155050. Tax rate of 475 on taxable income between 68201 and 155050. 599 148350 Page i.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. Find your gross income. For married taxpayers living and working in the state of Rhode Island.

Ad Access Tax Forms. The current tax forms and tables should be consulted for the. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have.

3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. 207700 to 231500 210750 to 234750.

Discover Helpful Information and Resources on Taxes From AARP. Rhode Island has a flat corporate income tax rate of 7000 of gross income. Your 2021 Tax Bracket to See Whats Been Adjusted.

Levels of taxable income. Rhode Island Gas Tax. A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island income of every individual estate and trust.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. Find Rhode Island income tax forms tax brackets and rates by tax year. The estate tax in Rhode Island applies to gross estates of 1648611 or more for deaths occurring after Jan.

Tax rate of 375 on the first 68200 of taxable income. Rhode Island Division of Taxation - Page 3 of 5. The income tax is progressive tax with rates ranging from 375 up to 599.

Complete Edit or Print Tax Forms Instantly. Enter here and on form RI-1040 or RI-1040NR Page 1 line 4 8. Income tax rate schedule.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. 2020 Tax Rate Schedule - FOR ALL FILING STATUS TYPES Taxable Income from RI-1040 or RI-1040NR line 7 Over 0 65250 But not over Pay---of the amount over 375 475 on excess 0 65250 148350 65250 148350. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

15 Tax Calculators 15 Tax Calculators. Of the on amount Over But Not Over. Multiply line 1 by line 7.

Beginning on January 1 2020 every employer thats required to deduct and withhold Rhode Island personal income tax and that had an average tax amount of 200 or more per month for the previous calendar year must file a return and remit the payments by electronic funds transfer or by other electronic means as defined by the Division of Taxation. Detailed Rhode Island state income tax rates and brackets are available on. Which was 5950 for 2020 will be 6000 21.

1 Rates support fiscal year 2020 for East Providence. Find your pretax deductions including 401K flexible account contributions. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

DO NOT use to figure your Rhode Island tax. Ad Compare Your 2022 Tax Bracket vs. 2021 Tax Year Return Calculator in 2022.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Both Oklahomas tax brackets and the associated tax rates were last changed six years prior to 2020 in 2014. The rate for new employers will be 116 percent including the 021 percent Job Development Assessment.

The Rhode Island tax is based on federal adjusted gross income subject to modification. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

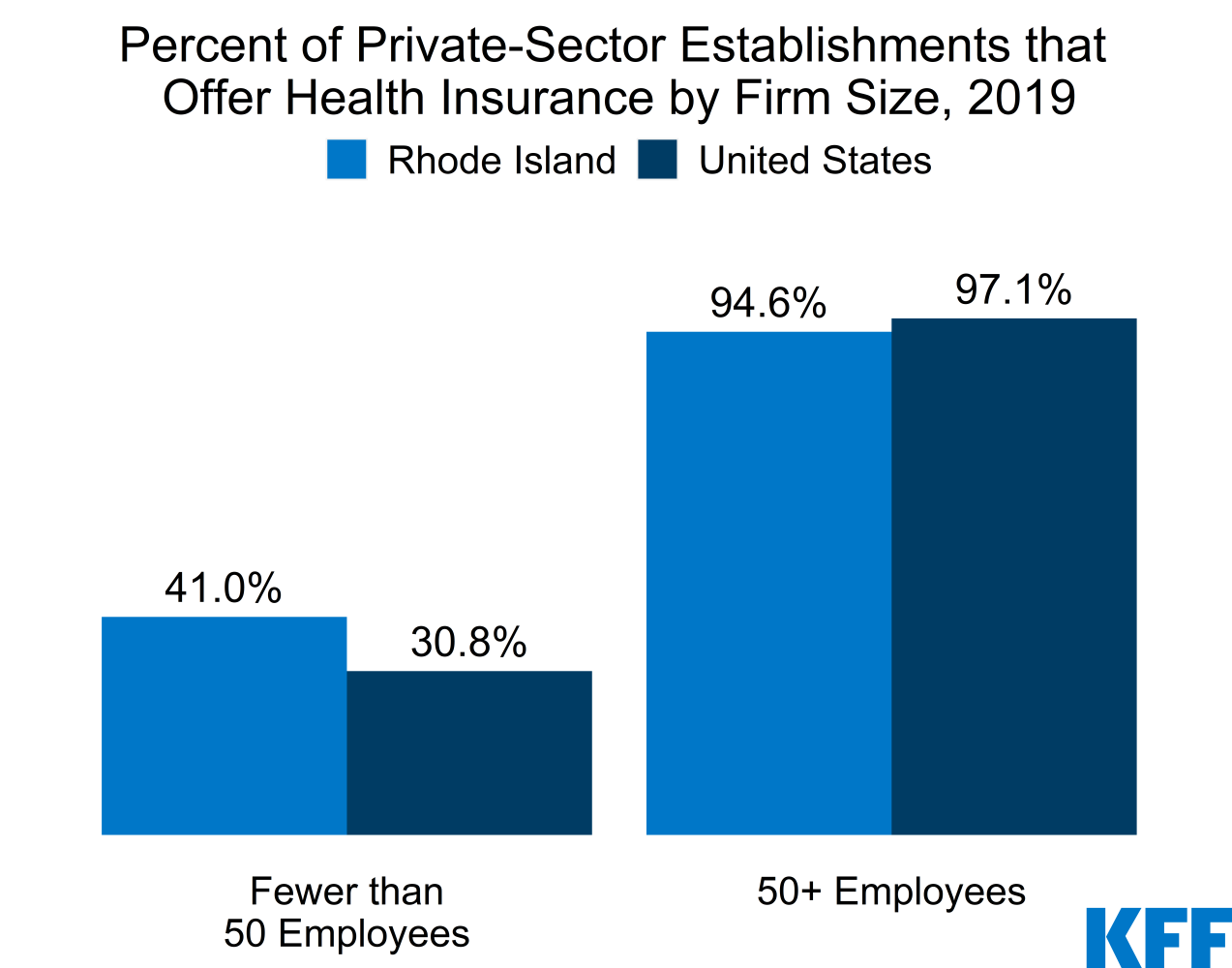

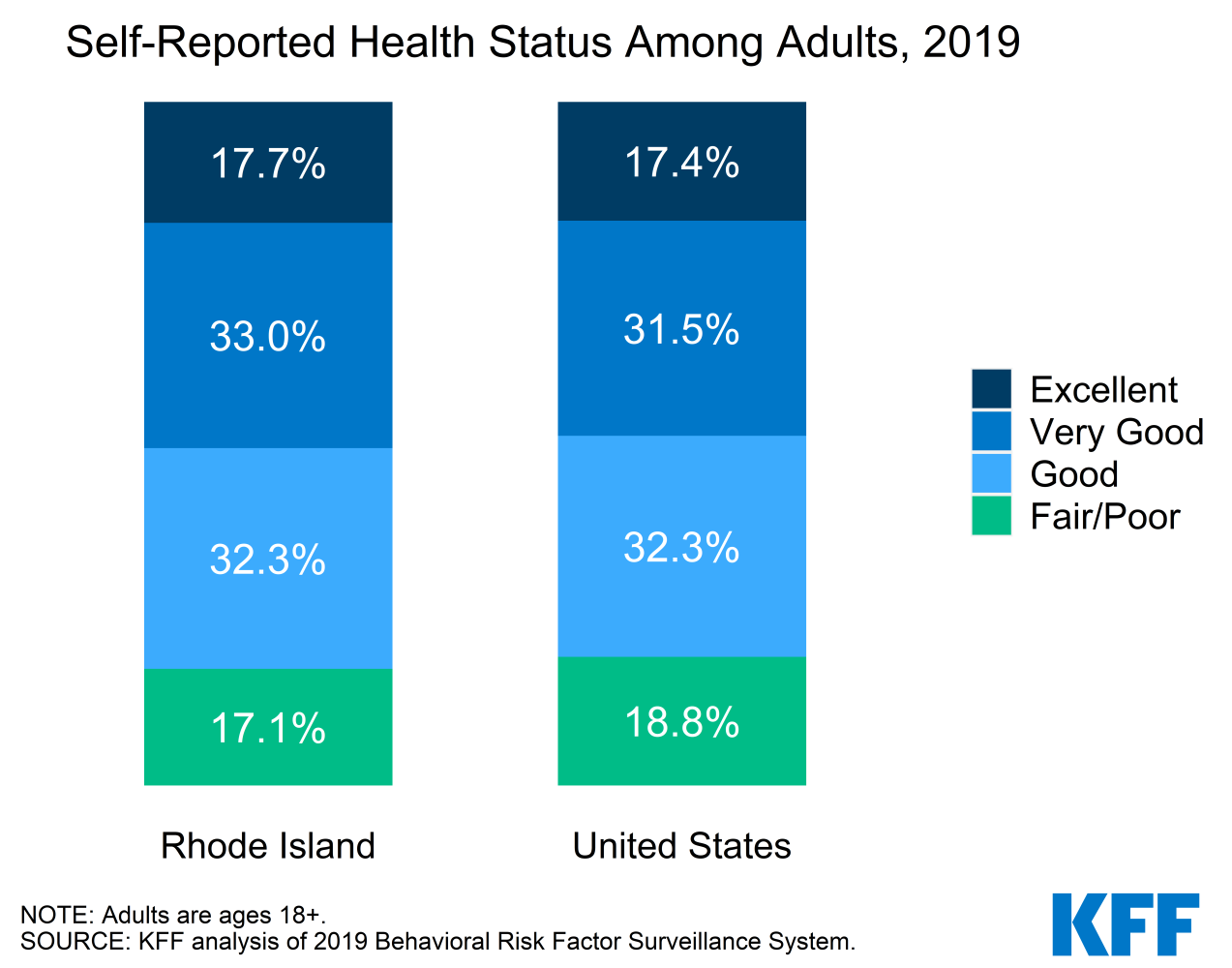

Election 2020 State Health Care Snapshots Rhode Island Kff

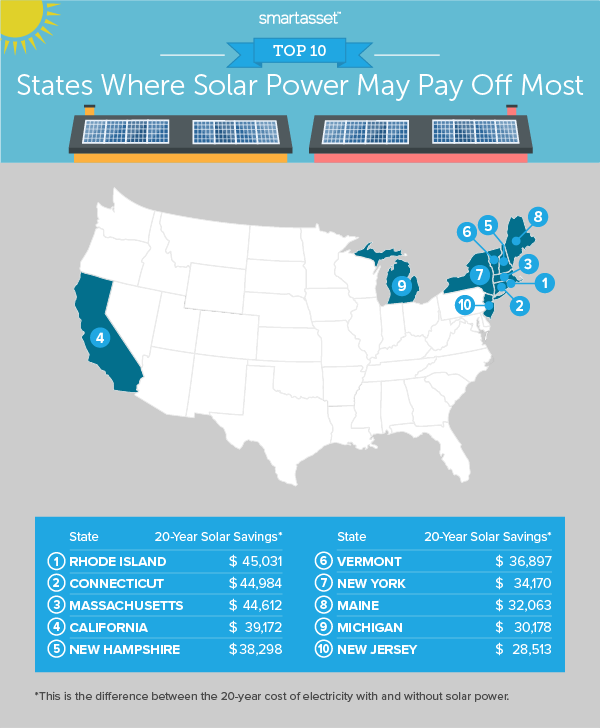

Are Solar Panels Worth It In 2020

How To Prepare And File A Rhode Island Income Tax Amendment

Rhode Island Income Tax Calculator Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Rhode Island Income Tax Calculator Smartasset

The Road To 100 Renewable Electricity By 2030 In Rhode Island Brattle

Election 2020 State Health Care Snapshots Rhode Island Kff

What Are Estate And Gift Taxes And How Do They Work

State Income Tax Returns And Unemployment Compensation

Rhode Island Income Tax Calculator Smartasset

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Election 2020 State Health Care Snapshots Rhode Island Kff

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

States With No Estate Tax Or Inheritance Tax Plan Where You Die

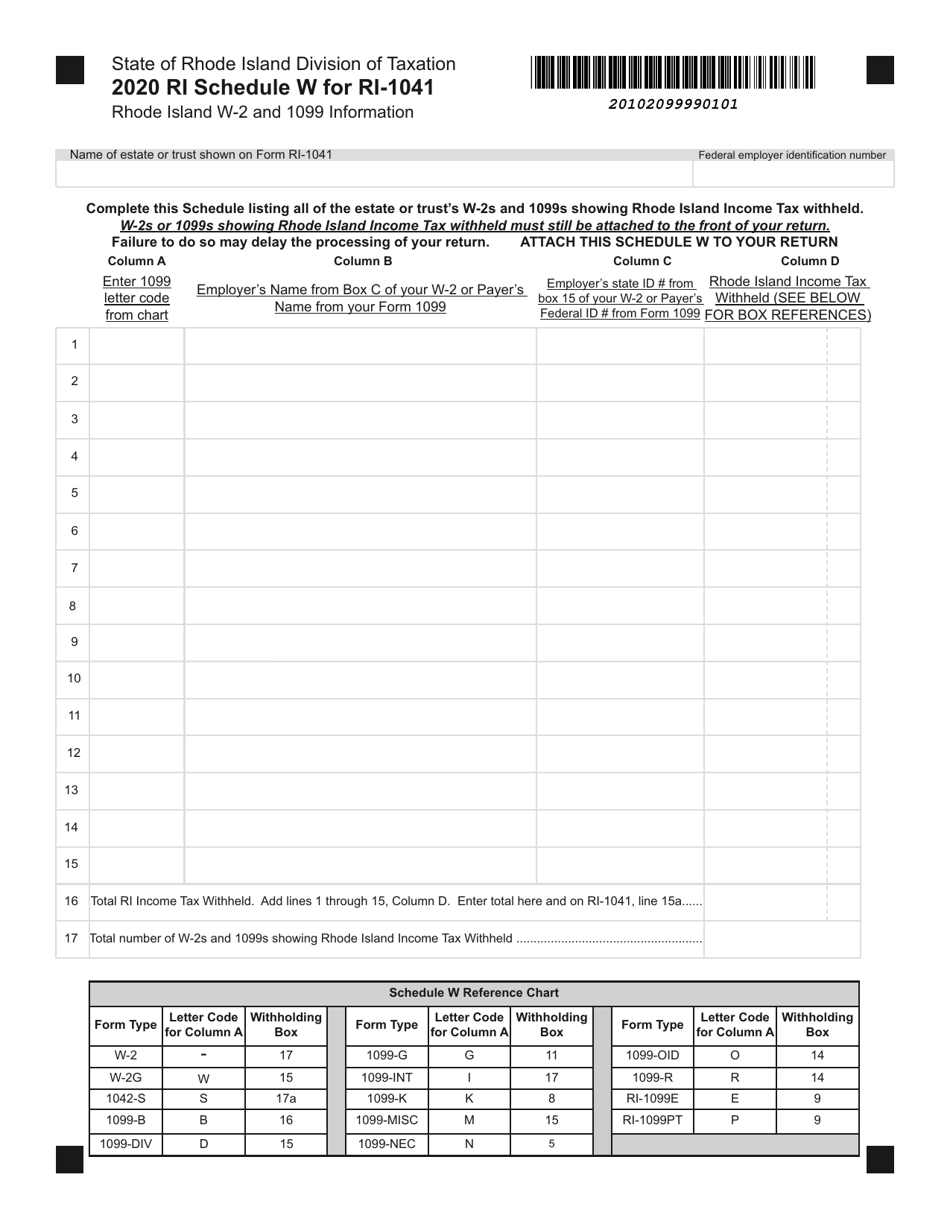

Form Ri 1041 Schedule W Download Fillable Pdf Or Fill Online Rhode Island W 2 And 1099 Information 2020 Rhode Island Templateroller